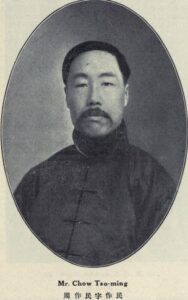

Chou Tso-min (1884-8 March 1956), founder of the Kincheng Banking Corporation, was noted for his pioneering efforts in the development of modern banking practices in north China. Huaian, Kiangsu, was the birthplace of Chou Tso-min. His father was a scholar who had obtained the chü-jen degree. Chou received his early education at home from private tutors. About the turn of the century, he went to Shanghai, where he enrolled at the Nanyang Academy, the predecessor of Communications University. Although he was not graduated from Nanyang, he went to Japan and studied law at Kyoto Imperial University from 1905 to 1911. After his return to China, Chou went to Peking, where he served as a section chief in the treasury department of the ministry of finance in the newly established republican government. Soon he was made director of that department. In 1916 he became the manager of the Bank of Communications branch at Wuhu, Anhwei. Then he was transferred to Peking as chief auditor in the head office of the bank. Chou Tso-min recognized the need for developing modern commercial banking in north China to meet the growing demands ofeconomic development there. He therefore founded the Kincheng Banking Corporation at Tientsin in 1917. Chou served as general manager and in 1920 also became chairman of the board of directors. The bank was initially capitalized at CNS500 thousand; soon it had CN$4.6 million in deposits.

When the Kincheng Banking Corporation was established in 1917, there were only three private commercial banks in the area. Under Chou Tso-min's vigorous direction, the Kincheng Banking Corporation set a pattern of modern banking practices. In the five years after 1917, eleven new commercial banks, all emulating Kincheng, were established in north China.

In 1923 the Kincheng Banking Corporation, the Yien-yieh Bank, the China and South Seas Bank, and the Continental Bank pooled their resources to establish a Joint Savings Society and Joint Treasury. Chou Tso-min served as an executive director of the joint operation. These four banks came to be known as the pei ssu-hang [four northern banks]. Chou also became a member of the board of directors of the Bank of China and of the Bank of Communications. In addition, he served as chairman of the Peiping Bankers Association and the Peiping Chamber of Commerce.

By 1937 the Kincheng Banking Corporation had increased its capital to CN$7 million and its deposits to CN$170 million; it had become a leading private commercial bank in north China. Its volume of deposits compared favor-ably with the Shanghai Commercial and Savings Bank, directed by K. P. Ch'en (Ch'en Kuang-fu, q.v.). In the years before 1937 the bank had established 65 branches in China, of which some 60 percent were located in north China. The Kincheng Banking Corporation contributed to the economic development of China by investing in industrial, mining, and transportation enterprises; loans in these three fields comprised about 40 percent of the bank's total loans during the period before the outbreak of war in 1937. In the industrial field, it cooperated closely with the Yung-li Chemical Works of Tientsin, the largest chemical enterprise in republican China, and with its affiliates, the Chiu-ta Refined Salt Company and the Golden Sea Industrial Research Institute. Textile mills financed by the Kincheng Banking Corporation included the Yu-yuan and Peiyang cotton mills at Tientsin, which together operated some 80 percent of China's spindles, and the Sing-yu Mill at Shanghai, operating about 5 percent of China's spindles. In the shipbuilding field, the bank gave financial support to the Chung-hua Shipbuilding and Engineering Company at Shanghai. The Liu-ho-kou Coal Mining Company, located at Anyang, Honan, also received loans from the Kincheng Banking Corporation. The fifth largest colliery in China, Liu-ho-kou produced about 1,000,000 tons of coal annually before the war. After the reorganization of the Chung-hsing Coal Mining Company in Shantung after 1929 (see Ch'ien Yung-ming), the Kincheng Banking Corporation became a member of the consortium that made a substantial loan to modernize Chung-hsing's operations and to restore production. Kincheng investments in railroads and railroad improvements in China also were significant.

Although it was a commercial bank, the Kincheng Banking Corporation was a pioneer in the field of agricultural credit in north China. In 1934 the bank lent funds to establish the North China Agricultural Improvement Institute, with the objective of improving cotton production. The institute was established in cooperation with Nankai University at Tientsin (see Chang Po-ling) and the Mass Education Promotion Association headed by James Yen (Yen Yang-ch'u, q.v.). Other universities, including Tsinghua and Cheeloo, soon came to support the organization. In 1935 the Cotton Improvement Association of Hopei province also joined the institute. Through the initiative of the Kincheng Banking Corporation, a joint rural credit group was established to extend loans to agricultural production and marketing cooperatives in the provinces of Hopei, Shansi, Shensi, Honan, and Anhwei. In this undertaking, the Kincheng Banking Corporation assumed responsibility for all cotton loans in Hopei province, where funds were advanced to more than 300 cooperatives.

Chou Tso-min was also a pioneer in the field of insurance in China. In 1929 he established the Taiping Insurance Company as a subsidiary of the Kincheng Banking Corporation with an initial capital of CNS500 thousand. The company specialized in fire, marine, and automobile insurance. Four years later, the company was enlarged, with the Bank of Communications, the Continental, the China and South Seas, the Kuo-hua (China State), and the Tung-lai banksjoining in the financial operation it increased its capitalization to CN$3 million and added life, war risk, and casualty insurance. The Taiping Insurance Company, with Chou Tso-min as its general manager, became a leading Chinese insurance company of the pre1937 period. In addition to his other responsibilities, Chou was the leading figure in the organization of the Tung-chen Produce Company in 1920, and he later served as its general manager. Operating three departments—trading, storage, and shipping—that company dealt in cotton, coal, and cereals. It owned ten small steamers and had warehouses in the principal commercial ports of China.

After the outbreak of the Sino-Japanese war in 1937, the Kincheng Banking Corporation gradually established 30 new branches in the provinces of west China and continued to provide financial assistance to industrial, mining, and transportation enterprises in the interior. Particularly notable was the aid provided to the Ming-sung Industrial Company of Szechwan, operated by Lu Tso-fu (q.v.), and to its related enterprises, including the Ming-sung Machine Works, the Ta-ming Textile Company, and the T'ien-fu Coal Mining Company. After the Japanese surrender in 1945, Chou Tso-min and Lu Tso-fu collaborated in establishing the Pacific Steamship Company, which bought and operated three ocean-going vessels for the China coastal trade.

When the Chinese Communists occupied the mainland in 1949, Chou Tso-min was in Hong Kong. As the banking business declined under the new dispensation, labor demands rose. In an attempt to save the situation, Chou returned to the mainland in 1950 to resume charge of the operations of the Kincheng Banking Corporation, to which he had devoted more than three decades of his life. However, in September 1951 the private banks of north China were amalgamated. In November 1952, all private banks in the People's Republic of China were converted into joint state-private enterprises, and the Kincheng Banking Corporation lost its legal and financial identity. Chou Tso-min then retired. He died in Shanghai on 8 March 1956 after suffering a heart attack.

周作民

周作民(1884—1956.3.8),金城银行的创始人,在华北推行近代银行管理制度而著名。周作民在江苏淮安出生,他父亲是一名举人。周作民幼年在家中从师受业。在本世纪初,他去上海进交通大学的前身南洋公学,未毕业即去日本,1905—1911年进京都帝国大学,学法律。他回国后到北京,任新成立的民国政府的财政部库藏司长,1916年任交通银行芜湖支行经理,不久回北京任总行稽查长。

周作民认识到华北在经济发展方面的日益增长的要求,需要在那里发展现代商业银行业。于是,他于1917年在天津创办金城银行,任总经理,1920年任董事长。该行开办资本为五十万元,不久即拥有四百六十万元存款。1917年金城银行成立时,该地区只有三家私人商业银行。由于周作民的积极指导,金城银行成为近代银行业的范例。1917年后的五年间,在华北先后有十一家新的商业银行仿效金城银行而成立。

1923年,金城、盐业、中南、大陆四家银行汇集它们的资金成立了联合储蓄会和联合金库,周作民任常务董事。这四所银行就是知名的北四行。周作民后来又任中国银行和中国交通银行董事,兼任北平银行公会和北平商会主席。

1937年,金城银行增加资本至七百万元,吸收存款达一亿七千万元。成为华北首屈一指的私人银行。它的存款额比陈光甫经营的上海商业储蓄银行还多。1937年前,在全国已有支行六十五处,其中百分之六十设在华北。

金城银行向工业、矿产和交通事业投资,以助中国的经济发展。1937年战争爆发前,给予上述三项事业的贷款占该行总贷款额的百分之四十。在工业方面,与天津永利化工厂(中国最大的化工企业)及其所属的久大精盐公司、金海实业研究所密切合作。在纺织业方面,金城银行给予财政资助的有天津裕源、北洋棉纺厂,这两家工厂占全国纱锭的百分之八十,又对占全国纱锭百分之五的上海新裕纱厂给予财政资助。在造船业方面,给予上海中国造船工程公司以财政资助,河南安阳的老河口煤矿公司也从金城银行得到贷款。老河口是中国第五位的煤矿,战前年产百万吨煤。山东中兴煤矿公司在1929年改组后,金城银行成为向中兴公司提供贷款的银行团的一个成员,该银行团为中兴矿的现代化和恢复生产提供了大笔贷款。金城银行在铁路方面的投资也是很可观的。

金城银行虽系商业银行,但在华北的农业贷款方面也是个首创者。1934年该行为建立华北农业改进研究所提供贷款,该所为改进棉花生产而设立。该所的建立得到天津南开大学、以及晏阳初的平民教育促进会合作,其他的大学,如清华、齐鲁也来支援该组织,1935年,河北省棉业改进会也加入了这个研究所。由金城银行发起,建立了一个农村贷款联合团对冀、晋、陕、豫、皖的农业生产运销合作组织给以信贷,在发放信贷工作中金城银行承办了河北全省的棉业贷款,款项贷给了三百多个合作组织。

周作民又是中国保险业的先驱者,1929年,在金城银行下附设太平保险公司,创办资本为国币五十万元,经营水、火、汽车保险。四年后,公司扩大,交通银行、大陆银行、中南银行、国华银行和东莱银行都参加进来,资本增加到国币三百万元,并增设了人寿、战争和灾难保险,周作民任总经理的太平保险公司,1937年前在中国是首屈一指的。

他在1920年成为通成产业公司的领导人物,后来担任该公司的总经理职务。该公司设三个部门——贸易、储存和船运——经营棉花、煤炭、粮食业务,拥有小型轮船十艘及在国内各主要商埠设立货栈。

1937年中日战争爆发后,金城银行在华西各省先后设立了三十个新支行,对内地工矿运输业给予财经资助,其中主要的有:卢作孚的四川民生实业公司,以及与民生实业公司有关的民生机器厂、大明纺织厂、天府煤矿公司等。1945年日本投降后,周作民、卢作孚合作创办太平洋轮船公司,有三只运洋轮船,经营中国沿海运输。

1949年共产党解放大陆,那时周作民在香港。在新的情况下银行业务衰落,而职员则要求加薪。为解决这个问题,1950年周作民回到大陆,希望恢复他经营了三十多年的金城银行继续营业。1951年9月,华北各私人银行合并。1952年12月,中华人民共和国各私人银行改为公私合营企业,金城银行当然不复存在。于是周作民退休。1956年3月8日,因心脏病在上海逝世。